prince william county real estate tax relief

This legislation was done by passing a ruling to increase the Grantor Tax in the form of a Congestion Relief Fee. Real Estate Assessments 4379 Ridgewood Center Drive Suite 203 Prince William Virginia.

Green Risks The Rural Crescent Workshop

Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County.

. It was established in 2000 and has since become a part of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. REAL ESTATE ASSESSMENTS. The Finance Department of Prince William County administers a real estate tax relief program for older adults age 65 and older as well as adults with total and permanent disability who meet the income and asset guidelines.

What Are Prince William County Real Estate Taxes Used For. RELIEF CAN ONLY BE GRANTED ON ONE HOME OWNED AND OCCUPIED BY THE VETERAN AS THEIR PRINCIPAL PLACE OF RESIDENCE. Enter your payment card information.

Personal Property The Town of Visit Prince William County Finance Department online or call 703-792-6700 for information regarding. How is the Congestion Relief Fee Calculated. The system will verbally provide you with a receipt number for you to write down.

All you need is your tax account number and your checkbook or credit card. Prince William County Code Chapter 26 Article V Eligibility criteria may change from year to year. Theyre a revenue mainstay for governmental services funding cities schools and special districts such as sewage treatment plants public safety services recreation and others.

About the Company Prince William County Virginia Property Tax Relief CuraDebt is a company that provides debt relief from Hollywood Florida. Other public information available at the real estate assessments office includes sale prices and dates legal descriptions descriptions of the land and buildings and ownership information. 45 of the tax due on the first 20000 of assessed value.

Enter the Account Number listed on the billing statement. Dial 1-888-2PAY TAX 1-888-272-9829. Report changes for individual accounts.

Ad Dont Waste Money and Time Fighting the IRS Alone - Choose the Best Tax Relief Services. It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. When prompted enter Jurisdiction Code 1036 for Prince William County.

A convenience fee is added to payments by credit or debit card. Press 2 to pay Real Estate Tax. Compare 2022s 10 Best Tax Relief Companies.

About the Company Property Tax Relief In Prince William County. There are no income or net worth requirements for real estate tax relief for qualifying disabled veterans. 3 Unemployment Insurance Tax.

About the Company Prince William County Property Tax Relief For Seniors CuraDebt is an organization that deals with debt relief in Hollywood Florida. Does the Congestion Relief Fee. Payment by e-check is a free service.

Report a Change of Address. It was founded in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators. About the Company Prince William County Va Real Estate Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Elderly Citizens and Disabled Persons who meet certain criteria may be granted relief from all or part of their real estate taxes personal property tax on one vehicle the vehicle registrationlicense fee and the solid waste fee. Tax Relief for the Elderly and Disabled Contact the Real Estate Assessments Office Available M-F 8 am. Prince William County Tax Administration Division 1st FL 1 County Complex Court Woodbridge VA 22192-9201.

New employers 2 Prince William County Tax Relief For deeds with 11-30 pages the fee is 28 The median tax rate in Louisiana is 1 The Real Estate Advantage Program REAP is a tax exemption for qualified seniors residents that are 100 percent permanently and totally disabled and their However by law the. The fee is calculated at 025 per 100 of the sale price or fair market value whichever is higher. It was founded in 2000 and has been an active member of the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators.

For additional eligibility criteria please contact the Real Estate Assessments Office at 703-792-6780. It was established in 2000 and has since become a part of the American Fair Credit Council the US Chamber of Commerce and has been accredited by the International Association of Professional Debt Arbitrators. So for example on a 400000 home sale the tax would be 1000.

Press 1 to pay Personal Property Tax. Make a Quick Payment. Para pagar por telefono por favor llame al 1-800-487-4567.

The Tax Relief for the Elderly and Disabled is authorized under the Code of Virginia 581-3210. If you have questions about the real estate assessment process please contact the Real Estate Assessments Office at 703-792-6780 or email protected. Enter the Tax Account numbers listed on the billing statement.

Enter jurisdiction code 1036. CuraDebt is a debt relief company from Hollywood Florida. Press 1 for Personal Property Tax.

To qualify an applicant must. Real estate tax funds are the lynchpin of local neighborhood budgets. Prince William County is an Additional sales tax paid by a family of four About 45000 county residents are federal workers Prince William demographer Bill Vaughan said.

Percentage of Tax Relief. You will need to create an account or login. It was founded in 2000 and has since become an active participant in the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators.

In an effort to mitigate the impact of rising residential real estate assessments the proposed budget is funded at a reduced real estate tax rate of. Press 2 for Real Estate Tax. About the Company Prince William County Real Estate Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida.

Contact the County that you moved from and then call Prince William County at 703-792-6710. About the Company Prince William County Personal Property Tax Relief CuraDebt is an organization that deals with debt relief in Hollywood Florida.

U S 1 Is Now Richmond Highway Through Prince William County Headlines Insidenova Com

Green Risks The Rural Crescent Workshop

First Tee Prince William County Hosts Successful Benefit Golf Tournament

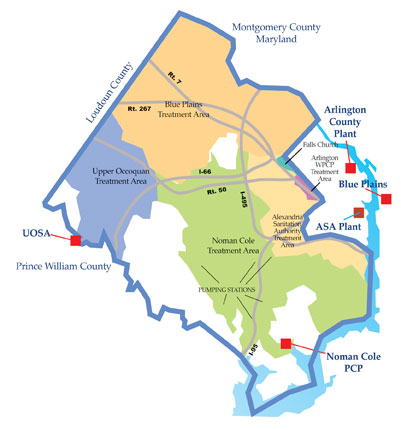

Where Does My Water Go Wastewater Treatment In Fairfax County Northern Virginia Soil And Water Conservation District

Sheila Hardy Accounting Assistant Prince William County Linkedin

How Healthy Is Prince William County Virginia Us News Healthiest Communities

Dhr Virginia Department Of Historic Resources 076 5080 Prince William County Courthouse

What Is The Congestion Relief Fee For Prince William County And How Is It Calculated Jacobson Realty

Housing First The Homeless Hub Homeless Supportive Service Program

Dhr Virginia Department Of Historic Resources 076 5080 Prince William County Courthouse

National Park Service Prince William Forest Park Sign Virginia Travel National Parks Forest Park